The waning of COVID-19 pandemic has triggered a surge in travel and expenses as professionals increasingly attend conferences and meet with clients. This shift has significantly heightened the demand for reimbursements across various industries.

According to findings detailed in “Generation Instant: Business Expense Reimbursements,” a PYMNTS Intelligence and Ingo Money collaboration, the number of consumers receiving business expense reimbursements has risen from 3.5% in 2021 to 5.5% in the last 12 months. The study leverages insights gathered from a survey of over 2,600 U.S. consumers to examine consumers’ satisfaction with disbursements received from government and nongovernment entities.

Further data suggests that millennials and high-income consumers are more likely to receive business expense reimbursements. In the last year, for instance, 9.4% of millennials and 9.5% of high-income consumers received reimbursements, compared to 2.8% of baby boomers and seniors and 1.7% of consumers earning less than $50,000 annually.

With the rise of digital payments, traditional reimbursement methods no longer meet the expectations of employees who prefer faster and more convenient payment options.

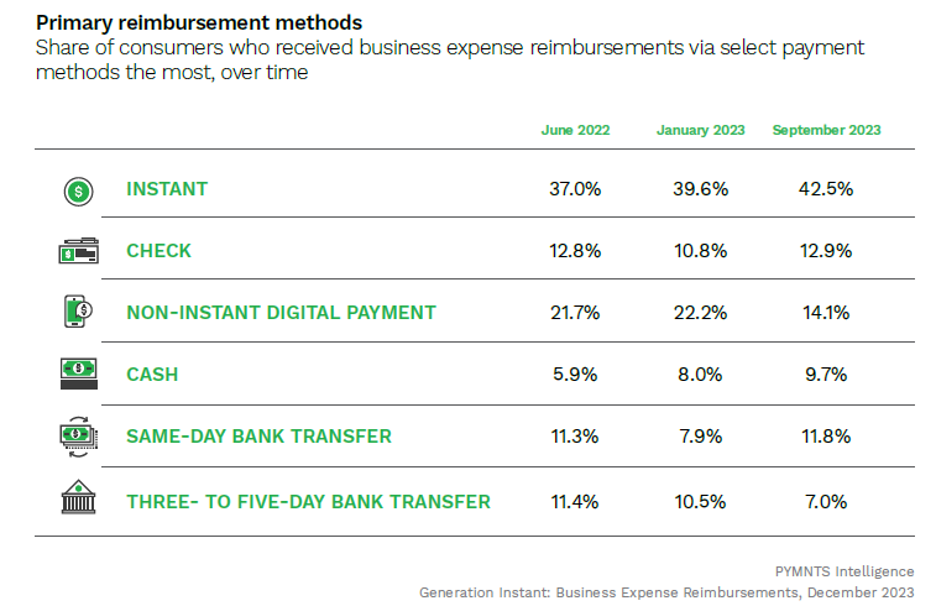

Against this backdrop, instant payments have gained popularity as the preferred method for business expense reimbursements, with close to half of consumers now preferring instant payments for receiving business expense reimbursements, representing a 15% increase from the previous year.

Employee satisfaction with instant payments also reached a high of 78% in 2023, compared to 70% across all payment methods, further highlighting the preference for instant payment methods.

Meanwhile, 71% of consumers received reimbursements through other methods, with non-instant digital wallet payments such as cryptocurrency, gift cards and payments to a PayPal account dominating as the most used, accounting for 14% of reimbursements. Checks still hold the second position, with 13% of consumers primarily receiving reimbursements via this method.

Analyzing the data further highlights a notable increase in those opting for same-day bank transfers and cash payouts since 2022, while the use of three- to five-day bank transfers has decreased. These shifts suggest a transition from traditional to instant reimbursement methods, catering to consumers who prioritize swift access to funds.

But despite the increasing prevalence of instant payments, a segment of consumers continues to opt against this choice. This reluctance stems from apprehensions about sharing payment credentials and a general lack of awareness regarding the availability of instant payment options.

These factors underscore the importance for enterprises to contemplate providing instant payment alternatives for business expense reimbursements to address consumer concerns and enhance overall accessibility.

In essence, as business travel and expenses continue to rise post-pandemic, adapting to evolving employee preferences for quicker and more convenient payment methods becomes imperative for businesses. Those proactively integrating instant payment solutions are well-positioned to not only streamline reimbursement processes but also enhance overall employee satisfaction and operational efficiency in the dynamic modern business landscape.