The impact of inflation on consumer spending has been a consistent concern throughout the year, and indications suggest that this trend is set to persist this holiday season.

As Walmart CEO Doug McMillon noted during a Q3 earnings conference call with analysts on Thursday (Nov. 16), despite “pockets of disinflation” particularly in categories like dry grocery and consumables, “pricing levels in many food categories continue to be a concern overall.”

McMillon added that “product costs are up versus last year, and they remain up even more on a two-year stack, which is putting pressure on our customers.”

Overall, the retail giant’s earnings report indicates a cautious outlook on consumers’ willingness to spend during this holiday shopping season. Chief Financial Officer John D. Rainey also noted a softening in sales during the latter half of October, adding that the fact that sales “have been somewhat uneven” gives the retail giant “reason to think slightly more cautiously about the consumer versus 90 days ago.”

Management further highlighted that while there was a 3% moderation in grocery inflation from the second quarter, when viewed over a two-year period, “it was still elevated at a high-teens percentage.”

Walmart’s announcement aligns with PYMNTS Intelligence findings indicating significant financial pressure on shoppers, particularly the 60%-plus Americans living paycheck to paycheck.

As PYMNTS data revealed back in August, despite inflation showing signs of easing, many Americans are struggling to pay bills and as a result have been compelled to adapt their lifestyles to align with their financial means.

In fact, millions of consumers have turned to cost-effective alternatives by purchasing less expensive brands, frequenting discount retailers, or reducing the quantity of certain items they buy, the study found. And these strategies, previously embraced across various income brackets, are anticipated to endure even as inflationary pressures ease.

Data captured in the most recent edition of the PYMNTS Consumer Inflation series also revealed that nearly 50% of grocery shoppers favor merchants offering lower prices, while 35% have shifted to purchasing lower-quality or private-label products. In addition to transitioning to more affordable brands and stores, consumers are displaying increased prudence and prioritizing value by actively comparing prices across various retailers.

Some consumers have taken it a step further and are curtailing nonessential retail spending, at least to some degree. Separate PYMNTS research published in “The Nonessential Spending Deep Dive Edition” report found that 75% of consumers have decreased their spending of nonessential grocery items — referred to as ‘nice-to-haves’ — in the past year. These items include products like desserts, soft drinks, snacks, and other indulgent or impulse purchases.

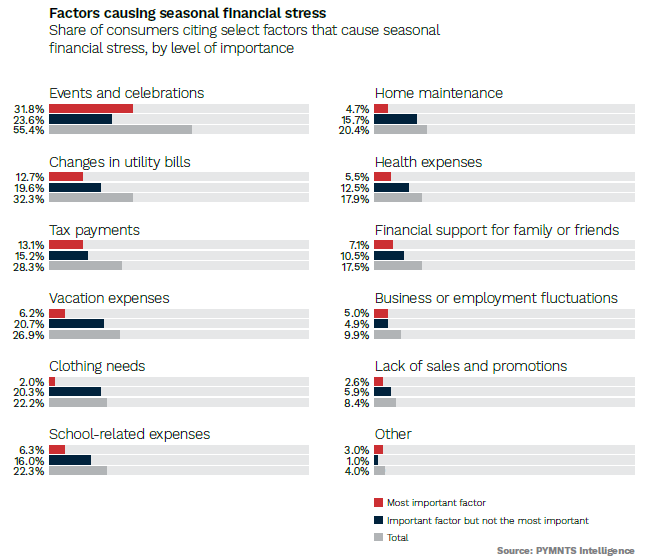

Looking ahead, the financial burden on consumers is expected to intensify in the upcoming weeks, especially considering that the holiday season poses significant financial challenges for over half of the population, with nearly 32% citing it as the primary source of their financial stress.

This also holds true for non-paycheck-to-paycheck consumers: “Seasonal fluctuations in financial conditions can induce 30 million consumers not living paycheck to paycheck to think and act as if they do live paycheck to paycheck,” per the study.