Why 50% of US Consumers Don’t Chase Merchant Deals

Nearly half of U.S. consumers say they shifted to brands and stores that offered steeper discounts than their usual retail and grocery haunts in the last year. Half of consumers also say that finding a better deal is now the most important criterion for deciding where to shop for retail and grocery products. But knowing how the other half of those consumers shop — and why they don’t chase deals — may be the difference between retailers who make a sale and those who make sales and drive profitable growth in 2023 and beyond.

Deal Chasing and Margin Eroding

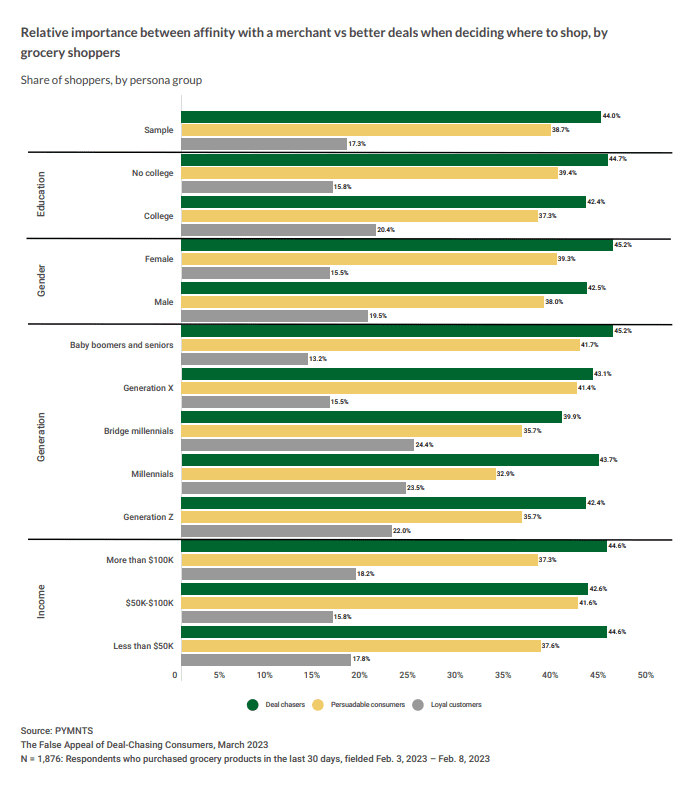

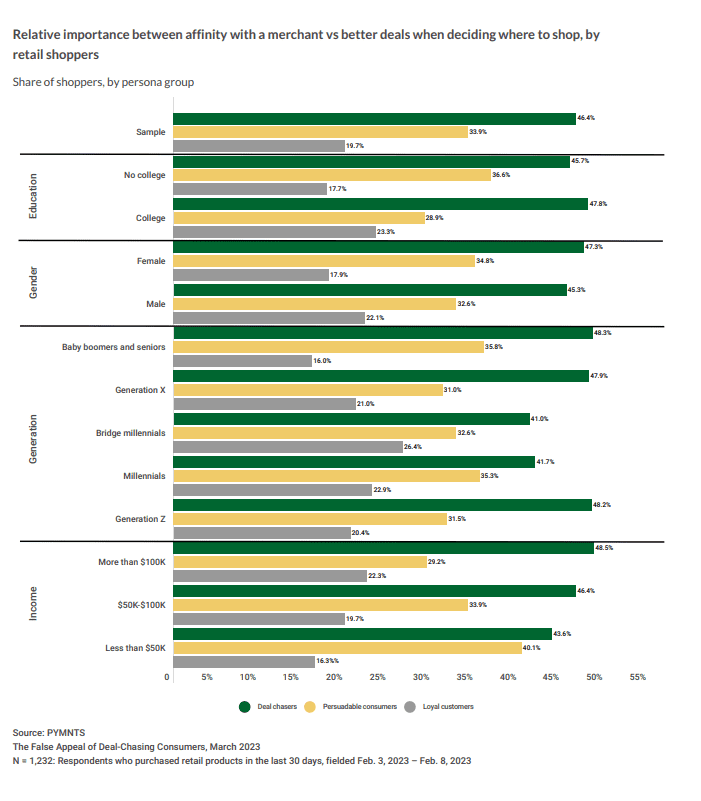

According to recent PYMNTS data, based on a representative sample of 2,116 consumers surveyed in February 2023, 44% of adult Americans say finding better deals has become a much more, if not the most, important factor when choosing where to buy retail or grocery items. The share of consumers who now say they are deal-chasers has increased steadily over the last six months.

With food inflation up by more than 20 percent over the last two years, deal-chasing consumers are on the hunt for better prices on food and willing to shop around, literally, to get them. Coupled with the increasing cost of credit card debt, everyday expenses and mortgage, rent and car payments, deal-chasers are also more willing to trade loyalty for the best deal on non-grocery retail purchases, too.

There are as many baby boomer deal-chasers as millennials, and as many deal-chasers who make more than $100,000 a year as those who make $50,000 or less. These are the same consumers who think it will take until August 2024 for the Fed to get to its 2 percent inflation target rate. Which means another 18 more months for deal-chasers to keep honing those skills and retailers to keep chasing them in the hope of getting them to stick around.

The problem is that they may not.

Sixty percent of deal-chasers say that the decision to make their most recent purchase was because they found the best deal there, suggesting that it takes little more than a better deal to get them to abandon their loyalty to a product or a store. For deal-chasers who want a new black dress for a night out in the town, the retailer with the cheapest black dress wins. The black shoes to go with that dress? That sale may not necessarily go to the merchant that sold a deal-chasing consumer the cheapest black dress.

As a shopping persona, deal-chasers are much more pessimistic about their own financial future and macro-economic conditions than others. This could explain why their loyalty is to their own bottom line, and brand loyalty now takes a back seat. Deal-chasers are more willing to to spend the time — and risk the uncertainty of shopping with an unfamiliar merchant or trying an unfamiliar brand — to keep chasing those deals.

But then there’s the 50% of consumers who aren’t chasing deals.

Certainty Matters More Than a Deal for the Other Half

Half of Americans (166 million consumers projected to the full adult population) don’t trade brand loyalty for deals — but not because they don’t want good value for money or have tens of thousands of dollars sloshing around their bank accounts waiting to be spent. Ease and convenience — and the certainty of their shopping experience with those brands — matter more.

Roughly 17% of U.S. consumers describe themselves as loyal to a merchant, where loyalty is defined as making most of their purchases with a small set of merchants they shop routinely. Need that black dress for a night on the town? Loyal shoppers are more likely to start first with their go-to retailers and buy there. They know the brand and the experience to be both familiar and reliable. Naturally, retailers know that too — and spend a lot of their data and dollars engaging those shoppers so that when the need arises, they get the first shot at that spend.

A disproportionate number of loyal shoppers are millennials and high-earners. Although small in numbers, relatively speaking, these loyalists are a powerful retail cohort because of the spending power they wield and their affinity with their favorite stores.

But so are one-third of consumers who fall somewhere in between. We call these consumers the “persuadables” because they actively straddle being loyal to a brand and getting a good deal.

Persuadables are largely middle-class consumers — those making between $50,000 and $100,000 a year. They shop as much online as they do in the physical store. More persuadables are women than men, and slightly fewer of them have a college degree.

Like loyal consumers, the circle of retailers they shop is small. But what makes these consumers persuadable is their loyalty to the products they like to buy, where they buy them and how buying them fits into their overall spend. Persuadables also say their employment prospects are more secure. Fewer persuadables than deal-chasers say that they or a family member have lost their jobs, and fewer believe that their jobs are at risk, than either loyal shoppers or deal chasers.

That makes persuadables more confident and financially stable shoppers, even if they are not as affluent as their loyal counterparts. As a shopping persona, they are less inclined to trade down, shop at cheaper merchants or sacrifice the quality of the items they purchase. For many brands, they are the ideal target audience.

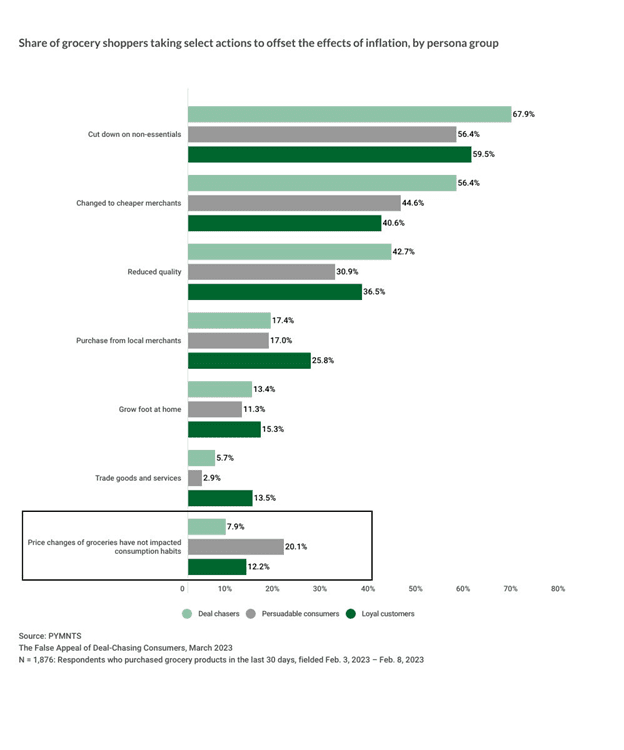

Instead, persuadables are more apt to cut back on other non-essential purchases to keep their pantries and closets stocked with the products that offer predictability and certainty.

For that reason, nearly three times as many persuadables as deal-chasers say their purchases have not been impacted by higher grocery prices, and one and half times that of loyal shoppers.

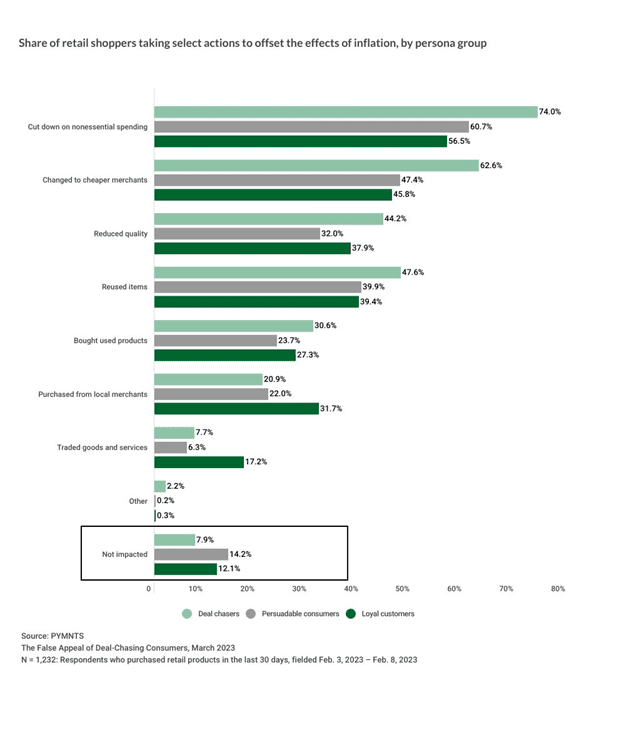

The same behavior holds true for retail purchases. Persuadables are twice as likely as deal-chasers to say they have been unimpacted by price increases, and even slightly more than loyal customers.

What’s most interesting, and potentially powerful for retailers, about this group is how much more likely they are to act like loyal shoppers.

That black dress? Persuadables probably have a particular brand they like and a store they usually shop to buy it. Whether they buy it at all likely depends on whether it fits into their overall spending that month.

Like loyalists, persuadables also don’t report they actively shop around for deals. If a retailer they don’t usually shop with happens to come along with a good deal on a favorite brand or a better way to pay for that purchase, they can be persuaded — provided that buying and paying for that purchase is made easy and convenient.

That’s what makes this group both persuadable and an attractive and potentially profitable customer segment for retailers who want consumers who value a good deal and the predictability of a great shopping and payments experience just as much.

Choices, Decisions, and the Value of Certainty

Scientists report that the average consumer makes about 35,000 decisions a day. That data set is from research published in 2013, and likely conducted years before. Over the last decade, the choices consumers have about everything — from the food they eat to the shows they watch on Netflix to the decisions they make as part of their day-to-day at work and at home — probably haven’t expanded the number of decisions they make. But the increasing number of choices has complicated how consumers make them, and the perceived risk that they’ll make the wrong one.

Many decisions that consumers make are based on habit — the cue, habit, routine feedback loop Charles Duhigg popularized in his book, The Power of Habit. Those habits create reliability, predictability and certainty of the outcome and make it easier and more efficient for consumers to navigate their day-to-day routine.

Other decisions are based on the consumer’s own risk-and-reward assessment of doing something other than what they usually do. Will doing something different save them time, or create more friction because the outcome or the process is uncertain?

The combination of historically high inflation and the now three-year digital shift has redefined consumer loyalty and how consumers choose the merchants they shop.

This is evident when examining the third-annual six-country study of 3,000 merchants and 13,000 consumers that PYMNTS recently published in collaboration with CyberSource. This study finds that the digital features that merchants offer — and how easy they make it for consumers to find and use them — is what attracts consumers and keeps them shopping.

Happily, for all of us who live and breathe payments, consumers across every country we studied say that it is payments choice that matters most, now for three years straight. Making it easy for consumers to pay how they want — using traditional and alternative ways to pay, including BNPL and digital wallets — is what drives merchant preference and consumer spend at those merchants. In the U.S., digital wallets, BNPL and contactless payments in stores are now considered table stakes. New ways to pay offer consumers more options and less friction when managing payment for their purchases and give retailers options to convert deal-chasers and keep persuadables and loyalists from straying.

Free shipping and free returns are table stakes, too. The decision to eliminate one or both is why U.S. merchants, overall, saw a decline in shopper satisfaction and conversion in 2022.

So, too, is making it easy for consumers to find and access digital features. The ability to see inventory availability is highly important to converting shoppers both online and instore — and critical to enabling a more robust buy online, pick up in store offering. For the U.S. shopper who has enthusiastically embraced the pickup economy, not having accurate information can kill that sale.

Offers and deals are important to all consumers, even loyal consumers and persuadables who say they want good value for money. But many merchants make finding and them getting them a hassle with email signups or promo codes that are buried, hard to find or emailed or sent via SMS. That friction creates a bad experience for a loyal or persuadable consumer who could be tempted to come for the deal and stay for other purchases if the experience were a good one. Deals and offers that are embedded into the payments flow can eliminate the friction from chasing the deal, or abandoning the sale because getting the deal just takes too many steps and too much time.

The Impact of Digital on Retail’s Risk and Reward Framework

What’s been interesting to observe over the three years we’ve done this study — and PYMNTS’ own studies during that time — is how wide the awareness gap has become between what merchants say they offer and what consumers say drives preference. To consumers, making it too hard to find the digital features they want to use is the same as not having those features available at all. Our analysis shows that a less friction-filled experience drives preference and satisfaction, and preference and satisfaction is what drives spend.

Innovators see these frictions and create new ways for consumers to achieve a better and more certain outcome. As more innovators create or enable better solutions with less friction, with more certainty and less risk for consumers, retailers will feel more pressure to change their own status quo or risk being left behind.

It’s why retailers are now examining their own shopping experiences and business models with a sharpened focus on where friction remains a threat to their business and where it can be an opportunity to attract those who want a more predictable shopping and payments outcome. Especially as more inflation-pressured, digitally-savvy consumers show up at their virtual and physical doorsteps in 2023.

Nearly all consumers who shop say they want value for money. Half of consumers define value as the best deal — the other half say it’s the best experience. It may be that payments become the viable bridge between both.

Retailers can turn deal-chasers into regular shoppers, at a margin, provided they have a business model that supports it and the continuous flow of deals to keep them hooked.