How much did payment fraud cost retailers last year? The answer, according to one analysis, is a cool $429 billion.

According to a recently released report from global financial technology provider Adyen, not only did fraudsters scam retailers around the globe out of $429 billion in 2023, but those attacks specifically cost enterprise retailers nearly $3 million, luxury fashion retailers nearly $4 million, and health and beauty brands $3.94 million.

In fact, Adyen estimated, nearly half (45%) of all businesses around the globe fell victim to fraudulent activity, cyberattacks or data leaks in 2023, which marked a 32% increase over 2022’s numbers.

It’s unclear from Adyen’s research exactly how many of these retailers are based in the U.S, or how many operate in the eCommerce sector, but according to PYMNTS Intelligence data, about eight in 10 U.S. eCommerce merchants doing international business fell victim to such attacks in 2023, and nearly all of them are committed to better fortifying their businesses against fraud as a result.

Ninety-five percent of merchants we surveyed for “Fraud Management in Online Transactions” said they have already begun enhancing their anti-fraud capabilities — or they are planning to start soon.

The report, which was completed in collaboration with Nuvei, drew on surveys with 300 payment and anti-fraud executives for U.S. companies with international sales. It found 41% of the companies surveyed had already taken steps to improve their anti-fraud toolkits. Fifty-four percent, meanwhile, told us they plan to do so this year. We also found that those merchants specializing in selling physical items were the most proactive, with 45% now upgrading their security capabilities. Only 37% of digital services providers are taking similar steps.

This need to bolster their anti-fraud prevention measures becomes especially clear in light of the fact that 82% of respondents told us they endured some form of fraud or breach last year.

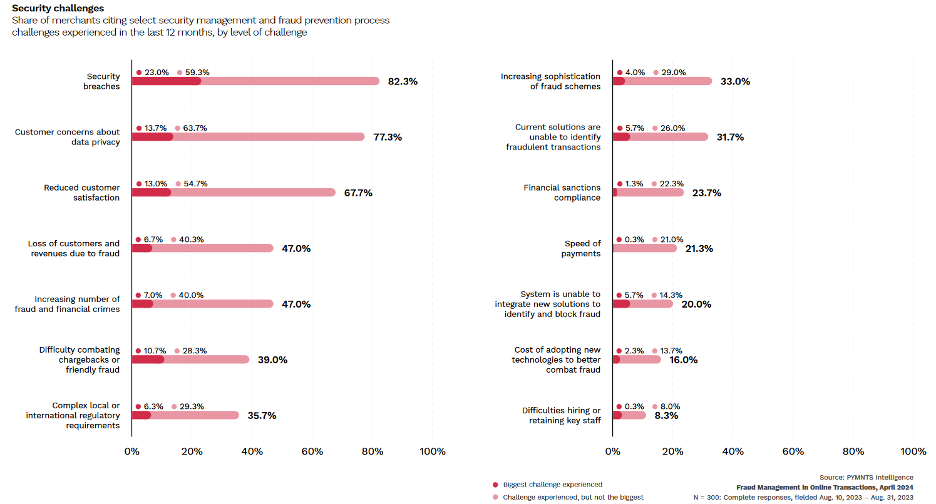

And, as the chart below illustrates, these incidents not only hit them financially, they also did reputational harm. Sixty-eight percent of respondents told us they saw a drop in customer satisfaction following a fraud incident, while 77% said the incident triggered data privacy concerns for their customers. Forty-seven percent told us they lost both customers and revenue specifically due to fraud.

The good news is that — according to “Fraud Management in Online Transactions” — enhancing anti-fraud measures doesn’t just protect a business’s bottom line; it can also drive higher degrees of customer satisfaction.

Ninety-three percent of respondents said that by improving security innovations, the customer experience also improved. In fact, more respondents said customer satisfaction improved as a result of enhanced anti-fraud measures than said actual fraud was prevented.

Eighty-one percent of merchants told us that an increase in customer satisfaction was a leading benefit of enhancing anti-fraud measures, with 21% saying it was the biggest advantage. Only 75% of respondents said preventing fraud was a benefit, and only about 20% of those believe fraud prevention was the biggest benefit.

In other words, not only will upgrading an anti-fraud tool kit help prevent a merchant from being victimized by the ever-growing threat of fraud, but it will also help protect a business’s reputation. By deploying the most sophisticated fraud prevention tools available, merchants can mitigate both financial loss and customer churn, ultimately safeguarding their market position and customer trust.