Digital banking is all the rage, right? Who can resist the convenience of using a bank app to balance accounts while waiting for the barista to brew a cup?

No one is denying the allure of digital banking, but according to The Wall Street Journal, old-school branch banking is back — at least for two of the world’s leading financial institutions.

J.P. Morgan Chase and Bank of America are both placing heavy bets on the appeal of brick-and-mortar bank offices, the report said. J.P. Morgan operates nearly 5,000 of them and plans to open 500 more in the next three years. Bank of America plans to open new outlets in four more states in the coming years, meaning it will have a physical presence in 39 states.

The reason for the branch buildout? Although both J.P. Morgan and Bank of America conceded that local offices won’t supplant the convenience digital banking offers, both also said they recognize physical locations give consumers a place to go when they want to discuss loans or seek financial advice.

It’s not only big banks that see the value of brick-and-mortar sites. Twelve percent of credit union members said they switched from traditional financial institutions to CUs specifically because their former banks didn’t offer a local presence, per PYMNTS Intelligence data.

Although branches have proven successful in converting former bank customers to credit union members, a new study from PYMNTS Intelligence showed local structures alone may not be enough to keep them.

“Growing Credit Union Membership via Lending and Omnichannel Banking Innovation,” which drew on survey responses from more than 4,500 U.S. consumers, revealed that 8 in 10 credit union members expect innovation from their primary financial institution — be it a bank or CU.

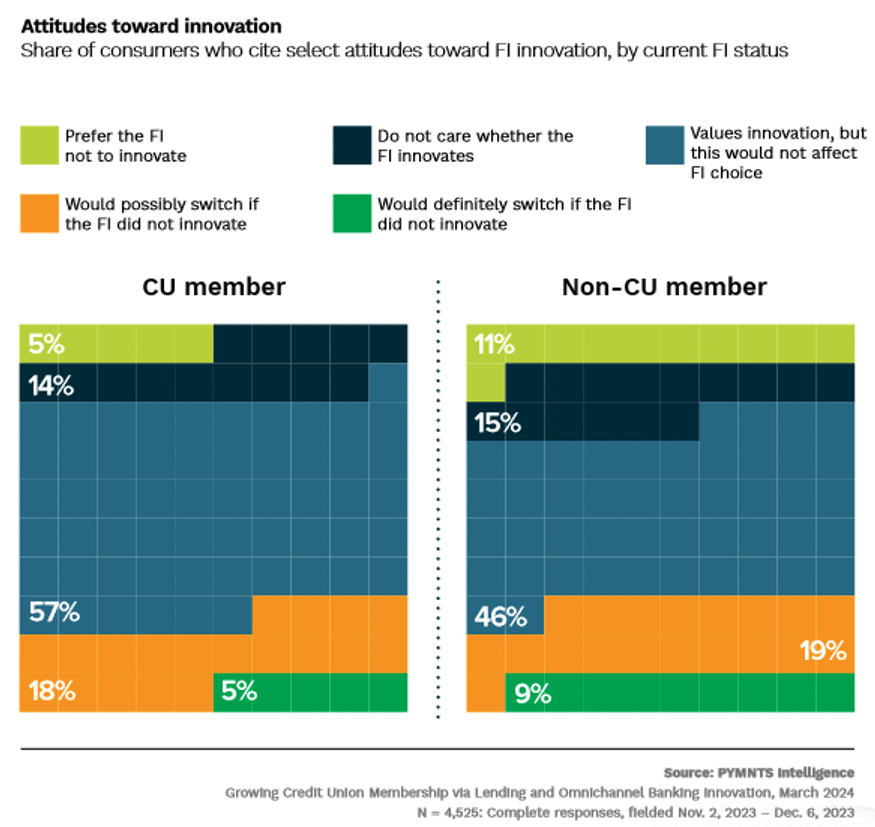

While traditional for-profit financial institutions enjoy a reputation of outpacing their nonprofit counterparts when it comes to services and products, credit union members are more likely than non-CU members to prioritize innovation, the report found.

Eighty-one percent of credit union members said they look for innovation when shopping for a financial services provider, while 74% of non-CU members said the same. Eight percent of CU members said they transitioned to credit unions because their financial institutions failed to meet their innovation expectations.

In other words, credit union members are the kind of consumers who expect their financial institutions to offer original financial products and services, so those institutions should not rest on their innovation laurels.

In other words, credit union members are the kind of consumers who expect their financial institutions to offer original financial products and services, so those institutions should not rest on their innovation laurels.

While 70% of CU members said their credit union innovates well or very well, CU members expect enhancements to more than four products and four features in the next three years. (Non-CU members have lower standards and only expect three products and three innovative features in that time.)

What features are they looking for? Eighteen percent said they want their primary financial institution to equip them with budgeting tools in the next three years. Five percent want to see innovations in personal loans, while 21% are looking for enhancement to auto loans. Seventeen percent of credit union members are also eager to see buy now, pay later innovations in the next three years, nearly double the percentage of non-CU members expecting the same.

These are just some of the enhancement credit union members are looking for. Their wish list also includes QR codes that grant access to accounts, voice assistants and more.

As the report makes clear, many consumers have turned their backs on traditional financial institutions in the past year in favor of credit unions. However, CUs nationwide have also lost members due to a lack of local branches and substandard mobile banking apps, among other things.

The fact that more credit union members were more willing to identify CU shortcomings than non-CU members indicates members are taking note of innovative offerings — and they appear ready to rejoin traditional financial institutions should credit unions fall behind.