The surge in digital banking has redefined the financial services landscape, appealing particularly to tech-savvy younger generations.

As digital transactions and mobile apps become commonplace, banks are at a crossroads. They must navigate the shift to digital while maintaining essential human interactions.

A PYMNTS Intelligence report “Why Digital-First Banking Does Not Mean Digital-Only” illustrated how this balance is crucial for retaining customers in a competitive market.

Digital banking’s popularity has soared, driven by the convenience of online transactions and the decline in physical branches during the pandemic. According to the report, 60% of millennials, 57% of Generation Z and 52% of Generation X primarily use mobile banking apps. This shift is not just about preferences but also about trust and satisfaction. The report showed that 97% of customers rated their digital banking experiences positively. Additionally, 94% approved of their overall access to financial services, and 79% said new technologies have enhanced their banking access.

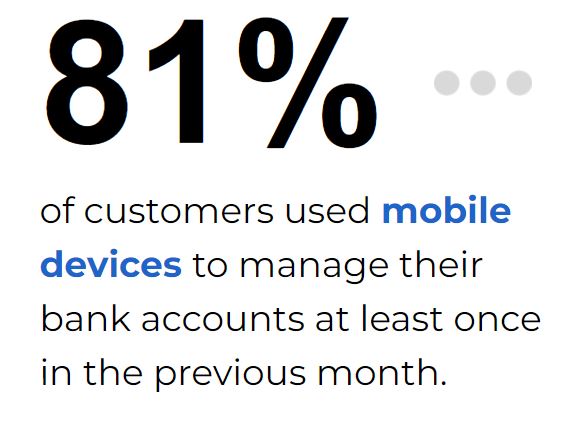

The technological landscape poses some challenges. Despite the growth of mobile banking —where 81% of customers manage their accounts via mobile devices monthly — issues like fraud and cybersecurity remain concerns. As of October 2023, 56% of banks have implemented eSignature verification for online transactions, an increase from the previous year’s 50%. This evolution illustrates banks’ efforts to secure digital transactions and ongoing consumer apprehension about digital security.

While digital banking platforms are widely embraced, customers still value the human element, especially for complex financial transactions. The report revealed that 71% of consumers are anxious about generative AI in financial services, with only 58% feeling comfortable with banks using such technologies. Seventy-two percent of bank customers rated personalized services very highly, particularly in contexts like fee avoidance, where human advisers often outperform automated systems.

As banks rely on automated platforms, there is a growing demand for services that blend digital convenience with personal interaction. Customers seeking specific financial advice or dealing with major transactions often prefer face-to-face interactions to navigate the complexities of their financial needs effectively. This preference underscores the importance of maintaining human touchpoints in an era dominated by digital solutions.

The imperative for banks to balance digital and in-person services is emphasized by customer behavior trends. According to the report, 25% of bank customers switched financial institutions in the past year, with 51% seeking better digital experiences and 39% desiring improved customer service. This customer churn rate highlights how crucial it is for banks to address digital and personal service aspects to avoid losing clients to competitors.

Additionally, banks face risks from digital friction. One study reported that 48% of customers experienced difficulties with online account applications, leading to 68% abandoning the process and 48% seeking alternative banks. Complex or frustrating digital experiences can directly impact customer retention, underscoring the need for banks to streamline their digital interfaces while ensuring robust support systems.

While digital banking provides unmatched convenience and efficiency, it cannot fully sustain customer loyalty on its own. Banks must blend personalized human interactions with their digital services to meet complex needs and foster strong customer relationships. The key to success in the evolving financial sector lies in balancing digital innovation with a human touch.