Cardinal Credit Union, a 71-year-old CU based in Ohio, is rooted in bringing financial education to the community and in educating younger generations. But the key to its future success lies in a continuum of digital and a brick-and-mortar, in-branch experience.

Christine Blake, CEO of Cardinal Credit Union, told PYMNTS that the firm’s recent debut of a suite of new digital capabilities seeks to deliver data-driven, personalized experiences no matter where and when members choose to conduct their daily financial lives.

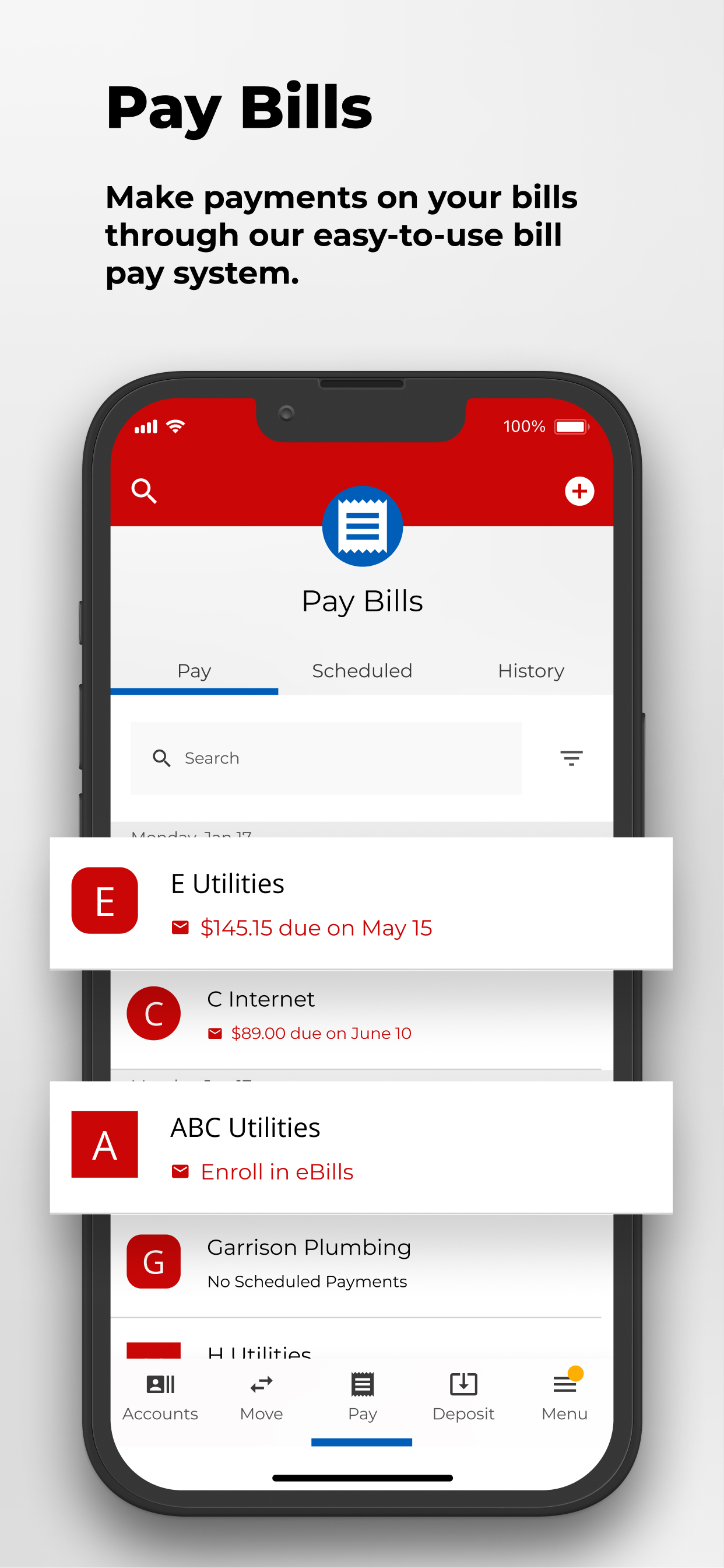

Cardinal Credit Union launched its new online banking platform late last month, with features spanning personalized financial recommendations, and a “holistic dashboard” to track finances, along with real-time payments and automatic transfers, along with a real-time chat function with a live person. Partners include Lumin Digital and Velera.

Cardinal Credit Union launched its new online banking platform late last month, with features spanning personalized financial recommendations, and a “holistic dashboard” to track finances, along with real-time payments and automatic transfers, along with a real-time chat function with a live person. Partners include Lumin Digital and Velera.

The launch belies the conventional wisdom that smaller banks do not need to be as digital as their larger brethren — simply because their customers don’t expect them to be digital.

“That’s not where anybody is today,” Blake said, adding that “everything in payments is on your phone — your debit card, credit card, everything that you use is on your phone now … and things are just getting faster and faster.”

Speaking of things getting faster: Banking customers are becoming increasingly familiar with the potential inherent in real-time payments, and are demanding that the option be made available (though there are still some concerns about fraud). Open banking makes it possible to aggregate account data, while connecting banks and FinTechs to enable new services and products. Buy now, pay later (BNPL) options are seeing a groundswell of popularity … and all of it is being done digitally.

While it’s true that the credit union has its share of consumers who want a high-touch experience in the branch itself — they’ve got questions about loans, credit scores and want to meet face-to-face at times — there’s a growing need to deliver always-on, on-demand banking.

Customers are skewing ever-younger, and Cardinal Credit itself can bank on a wellspring of new members signing on as a result of its ongoing financial education programs that extend across five local high schools and Lakeland Community College. The credit union has designed a curriculum that helps attendees open accounts, use cards and tap modern technology as they learn more about banking.

The CU also conducts monthly financial wellness seminars, as its branches are transformed into financial education centers rather than existing as places to manage checking and savings accounts. Blake noted to PYMNTS that as the financial institution (FI) interacts with members in the branch setting, it has the opportunity to introduce those members to the digital offerings, guiding them through the experiences surrounding multifactor authentication and other features. Half of Cardinal’s staff is made up certified financial counselors who are well equipped to serve as informational sources for members. The digital offering is a natural complement to the branch interactions, she observed.

“We knew this was something that we wanted,” said Blake of the digital platform, “and it was just a matter of time before we could afford this and find the right partners to bring it to our members.”

As she told PYMNTS, with a nod to the streamlined experiences embedded in the platform. “People do not want to have to click five times to get somewhere — and they do not want to have to do a ton of research to find something … We want to make things simple and clear but have all the additional features you might need or want, while at the same time offering a beautiful experience to the member.”

The combination of the digital and tactile experiences, she said, caters to the tech savvy and the less technically-adept members, as data from its debit and credit partners and its technology providers offers insight into the trends that are shaping member expectations. Given the community and educational focus, Blake said that the newest offerings on Cardinal’s horizon are geared toward helping younger members branch out into investors. With Bits of Stock, as members use debit cards, they accrue rewards that can then be used to buy fractional shares of stock.

The focus for Cardinal Credit Union is to move people who might be used to the traditional banking space to a digital platform, said Blake. “If you want to be relevant tomorrow, you’re gong to need those technologies today — and we need those tools to bring people along, and we’re their trusted financial advisor.”