In the United Kingdom, digital wallets are not just tools for online payments; they are rapidly evolving into versatile companions for everyday tasks and transactions.

A recent PYMNTS Intelligence Report, “Digital Wallets Beyond Financial Transactions: U.K. Edition,” in collaboration with Google Wallet, reveals that 44% of British consumers plan to continue using digital wallets for financial transactions over the next three years. This statistic highlights a growing reliance on digital solutions during a shifting consumer landscape.

Additionally, Generation Z and millennial consumers are at the forefront of broadening the scope of digital wallet usage. Beyond typical transactions, these younger demographics are increasingly employing digital wallets for diverse purposes, such as peer-to-peer payments and event venue access. For instance, 37% of Gen Z consumers have utilized digital wallets for peer-to-peer payments or splitting bills, showcasing a trend toward integrating digital wallets into social and daily life activities.

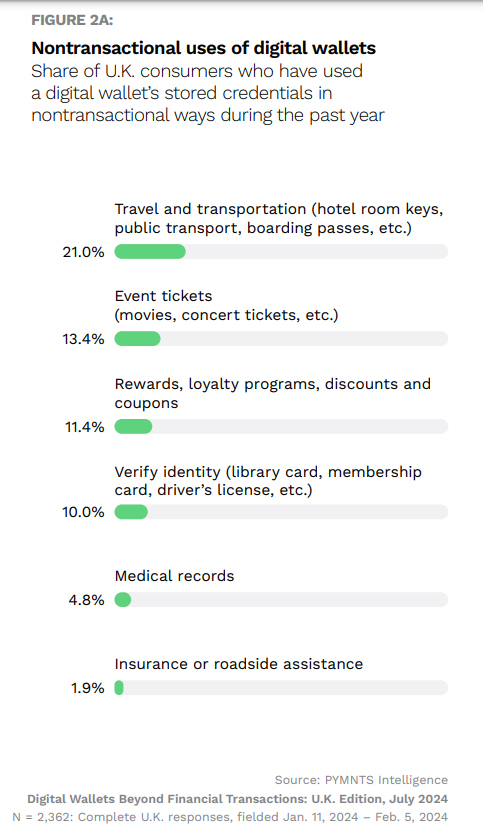

The report also highlights a significant shift toward non-transactional uses of digital wallets among U.K. consumers. A notable 21% have leveraged their digital wallets for travel-related needs, from presenting boarding passes to accessing transportation tickets. This adaptability reflects consumers’ growing comfort with digital solutions for managing everyday tasks beyond financial transactions.

The report reveals that more than 75% of U.K. consumers have used digital wallets over the past year, mainly for online shopping. This illustrates the convenience and growing acceptance of digital payment methods among British consumers.

Interestingly, digital wallets are increasingly serving purposes beyond financial transactions. For instance, they are being employed for travel-related needs such as storing boarding passes or transportation tickets. This diversification highlights the versatility and utility of digital wallets in facilitating everyday tasks beyond payments.

With digital wallets accessible via mobile devices, consumers find them convenient for scenarios like identity verification at events or even accessing digital services securely. This trend suggests a shift toward integrating digital wallets into various facets of daily life beyond the traditional retail transaction. According to the study, 37% of Gen Z and 27% of millennial consumers in the U.K. have used digital wallets to store credentials for non-transactional purposes.

Gen Zers and millennials are at the forefront of expanding the use cases of digital wallets. A significant percentage of these younger demographics in the U.K. are leveraging digital wallets for travel-related purposes, indicating a preference for digital solutions that enhance mobility and convenience.

According to the report, 88% of Gen Zers needed to verify their identities in the last year, with digital wallets being a preferred method for storing credentials. The widespread adoption of digital wallets among this demographic for identity verification illustrates their potential to extend beyond conventional payment contexts and become integral to everyday routines.

Younger consumers’ openness to using digital wallets for non-transactional purposes suggests they are paving the way for broader adoption among older demographics. As digital wallets become more integrated into daily routines, their utility and acceptance are likely to grow across all age groups.

The shift toward using digital wallets for identity verification, particularly among younger demographics, signals a broader acceptance of digital solutions for managing personal credentials and enhancing security.

Consider that 77% of U.K. consumers use at least one digital wallet. As consumer behaviors evolve, businesses and service providers are expected to integrate digital wallet functionalities more extensively.

These developments accentuate a significant shift toward digital solutions that enhance convenience, security and accessibility in everyday consumer interactions. The report anticipates continued growth in digital wallet adoption, especially for identity verification. With expanding adoption across demographics, businesses and service providers are likely to increasingly incorporate these technologies to meet evolving consumer expectations.