As retailers vie to capture consumer interest, the juxtaposition of Amazon Prime Day and Walmart+ Week underscores the evolving landscape of shopper loyalty.

A recent PYMNTS Intelligence report, “New Data: Shoppers Love Amazon Prime Day — But Spend More on Walmart+ Week,” sheds light on how these two major sales events stack up against each other in terms of participation and spending, revealing both opportunities and challenges for the retail giants.

Held July 16-17 this year, Amazon Prime Day saw record-breaking sales, with shopper spending climbing 11%, to exceed $14 billion. The event set a new high for the number of items sold, further cementing Amazon’s dominance in the sales event arena. According to the report, participation in Amazon Prime Day was significantly higher compared to Walmart+ Week. Approximately 40% of consumers engaged in Prime Day, while about 20% participated in Walmart+ Week. These figures, which were consistent with last year’s participation rates, highlight Amazon’s enduring lead.

Walmart+ Week, however, has shown notable growth since 2022. Participation in Walmart+ Week surged 71% from last year, up from just 12% in 2022. Despite Amazon’s strong performance, if this upward trend continues, Walmart+ Week’s participation could eventually close the gap with Prime Day.

The disparity in consumer participation between the two events can be attributed to the difference in their respective subscriber bases. Amazon Prime boasts a 67% subscription rate, compared to Walmart+’s 30%. This difference in subscription levels explains why Amazon Prime Day attracts a larger audience.

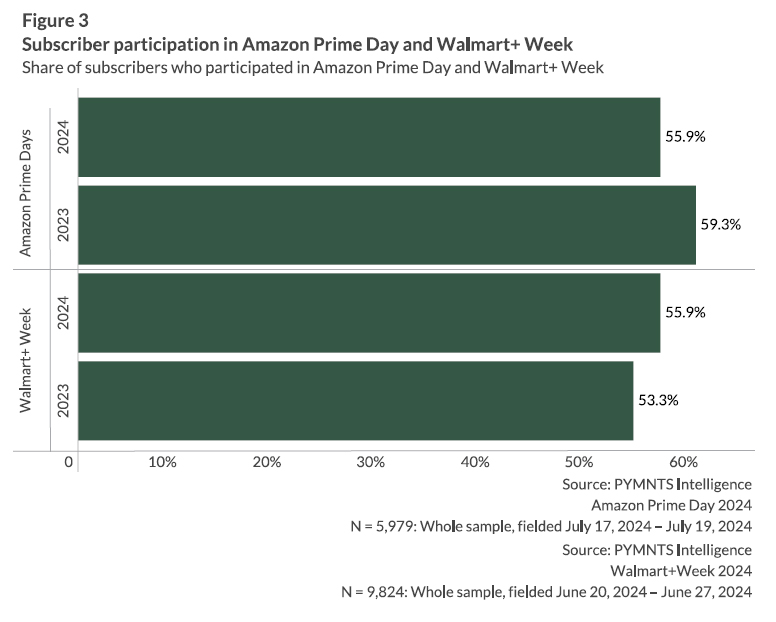

In the past year Walmart+ subscriptions have increased 30%, particularly among millennials and individuals earning less than $100,000 annually. Yet Walmart+ still lags behind Amazon Prime. Both sales events saw a 50% participation rate from their respective subscribers, suggesting that the events themselves are equally engaging. To increase overall consumer participation, Walmart must grow its Walmart+ subscriber base to match the extensive reach of Amazon Prime.

Despite having fewer participants, Walmart+ Week shoppers outspent their Amazon Prime Day counterparts. On average, Walmart+ shoppers spent $473 during the event, which is about 45% more than the $326 spent by Amazon Prime Day shoppers. This trend was pronounced among high-income consumers, who gravitated toward Walmart+ for high-ticket items and groceries. The increased spending by Walmart+ shoppers reveals the potential for greater revenue, even with a smaller subscriber base.

The comparison between Amazon Prime Day and Walmart+ Week illuminates a crucial aspect of the retail competition: the size of the subscriber base. Amazon Prime’s larger subscriber pool has enabled it to achieve higher overall participation and sales. But Walmart+ Week shoppers’ higher average spend indicates that revenue potential exists if Walmart can boost its subscriber count.

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.