The travel and hospitality sectors have long been anchored in traditional payment methods, like cash and credit cards.

As consumers and employees voice their frustrations with outdated systems, adopting real-time payment solutions could revolutionize the industry.

The PYMNTS Intelligence report “From Trips to Tips: How Faster Payments Can Elevate Travel and Hospitality” revealed that improved payment methods can streamline operations and enhance the experiences for customers and staff.

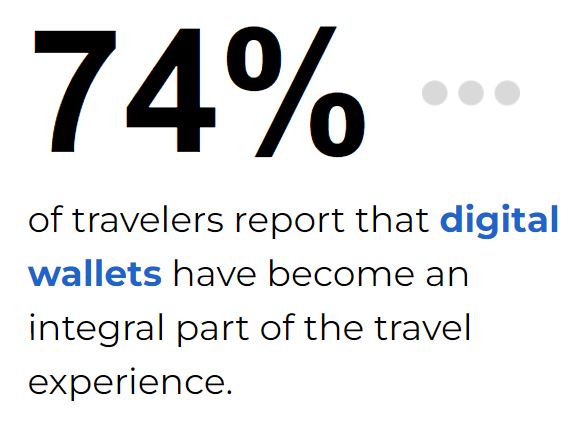

A shift is underway, as 74% of travelers said they regard digital wallets as essential to their experience, specifically pronounced among affluent and millennial travelers, with use rates at 83% and 82%, respectively. Customers using digital wallets spend an average of $44 per visit at restaurants, more than the $33 spent by those using traditional payment methods. This trend reflects a broader consumer preference for seamless, efficient payment solutions that enhance the overall travel experience.

The demand for instant tip payouts in the hospitality sector revealed another layer of this transformation. Nearly 82% of hospitality workers expressed a strong preference for receiving tips instantly, with 85% of those who already benefit from such systems reporting high satisfaction.

This swift access to earnings could be pivotal for attracting and retaining talent in a sector still recovering from pandemic-induced staffing shortages. Real-time payment solutions are not just about convenience; they are also a powerful tool for enhancing employee morale and operational efficiency.

Business travel is set for change with the introduction of instant payment options. Many employees front their travel costs, waiting for reimbursements that can lead to financial strain. According to the report, 43% of consumers now favor instant payments for business expense reimbursements, up from 40% in January 2023. This trend signifies an increasing expectation for rapid transaction processing in professional contexts.

Seventy-eight percent of employees expressed satisfaction with instant payments in business settings compared to 70% across all payment types. This escalating preference for speed in financial transactions reflects a broader cultural shift toward immediacy, and companies that adopt these technologies will likely see improvements in employee satisfaction and retention.

American Express, for example, launched an instant payment option through its Neo1 platform, allowing corporate travelers to manage expenses more efficiently. Such innovations illustrate how instant payments can modernize the business travel experience, reducing the burden of out-of-pocket costs.

While some travel and hospitality companies remain cautious about adopting new payment technologies, many are recognizing the competitive advantages that real-time payment systems can offer.

A survey of more than 10,000 hotel properties found that 71% of hoteliers said they believe guests view technology as empowering, with contactless payments being the most desired innovation. However, challenges persist, as 69% of hoteliers reported difficulties in integrating new technologies with legacy systems, leading to operational inefficiencies.

Despite these hurdles, the demand for improved payment solutions is rising.

Partnerships like that between Davidson Hospitality Group and the digital tipping platform eTip highlight how businesses can use technology to enhance both guest and employee experiences. By facilitating instant gratuity payments through QR codes, hotels not only boost staff earnings but also gain valuable insights into tipping patterns, ultimately improving guest satisfaction.

The travel and hospitality sectors are at a pivotal moment where embracing real-time payment solutions can meet modern consumer expectations and enhance overall satisfaction for guests and employees.