Open banking, which allows third-party providers to access banking data through secure application programming interfaces (APIs), has gained momentum globally as a means to enhance financial services. Recent U.S. regulatory developments may pave the way for increased adoption, particularly for real-time payments.

But a PYMNTS Intelligence report, “Can Open Banking Win Trust to Drive Real-Time Payments?,” created in conjunction with The Clearing House, shows how data security and privacy remain obstacles before open banking can realize its potential in the American financial landscape.

Although 46% of U.S. adults are interested in open banking, adoption lags at a mere 11%.

The Consumer Financial Protection Bureau (CFPB) has proposed a new rule under Section 1033 of the Dodd-Frank Act that aims to expand open banking in the U.S. This regulation would require financial institutions to share consumer data with authorized third parties while implementing enhanced privacy and security measures.

Although the proposal is a significant step toward broader adoption of open banking, it has faced criticism from industry groups like The Clearing House Association and the Bank Policy Institute, which argue that it does not sufficiently protect consumer data. Their concerns focus on practices such as credential-based access and screen scraping, which they believe could jeopardize data security.

U.S. and U.K. stakeholders remain skeptical about open banking due to concerns about data security. In the U.K., where open banking has been operational since 2018, 84% of consumers distrust its safety and 72% believe it benefits third-party providers more than consumers.

U.S. and U.K. stakeholders remain skeptical about open banking due to concerns about data security. In the U.K., where open banking has been operational since 2018, 84% of consumers distrust its safety and 72% believe it benefits third-party providers more than consumers.

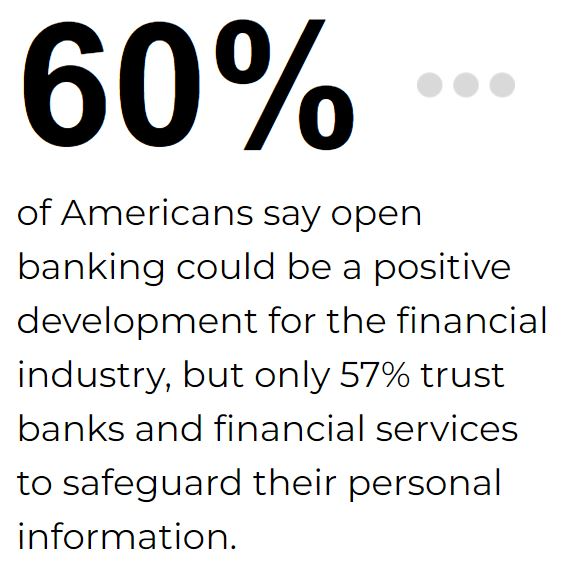

Additionally, businesses cite cybersecurity concerns as a barrier despite recognizing open banking’s potential benefits. In the U.S., while 60% of Americans view open banking favorably, significant concerns persist about data storage and collection practices. Only 57% of Americans trust financial institutions to protect their personal information, underscoring the need for improved trust and transparency.

Despite these challenges, open banking has the potential to transform the payments industry by facilitating real-time payments. Open banking could enhance the efficiency of account-to-account (A2A) transactions, offering a cost-effective alternative to credit card payments by reducing fees and fraud.

According to the report, proponents estimate A2A payments could reach $200 billion in consumer-to-business transactions in North America by 2026. The U.K. government is also encouraging the use of open banking to improve real-time payment systems and reduce transaction times.

For open banking to revolutionize real-time payments, it must address ongoing concerns about data security and privacy. Effective regulation and collaboration between public and private sectors are crucial in ensuring that the final rules safeguard consumer information while promoting innovation. By addressing industry concerns and creating a secure environment for data sharing, open banking can achieve its full potential, driving forward the adoption of real-time payments and expanding financial inclusion across various demographics.