As promotional events like Amazon Prime Days and Walmart+ Week escalate the rivalry between Walmart and Amazon, distinct consumer trends have emerged.

A recent PYMNTS Intelligence Report, First Look: Walmart+ Week Draws High-Income Shoppers Looking for Deals, reveals high-income participants were 2.3 times more likely to buy travel services and 1.5 times more likely to purchase electronics compared to regular Walmart+ subscribers.

Despite its emphasis on groceries, Walmart faces the challenge of retaining new subscribers drawn by event-specific deals. With 58.3% of online purchases during Walmart+ Week being on sale, Walmart must balance its grocery strengths with a diverse product offering to ensure long-term growth and maintain its competitive edge.

Walmart+ Week (held June 17-23 this year) displayed Walmart’s unique approach to online and in-store shopping events. According to the report, Walmart+ Week participants filled their carts with groceries and lower-cost items, rather than splurging on high-ticket items. On average, Walmart+ Week shoppers purchased 20 items, with a significant portion consisting of everyday groceries and health products.

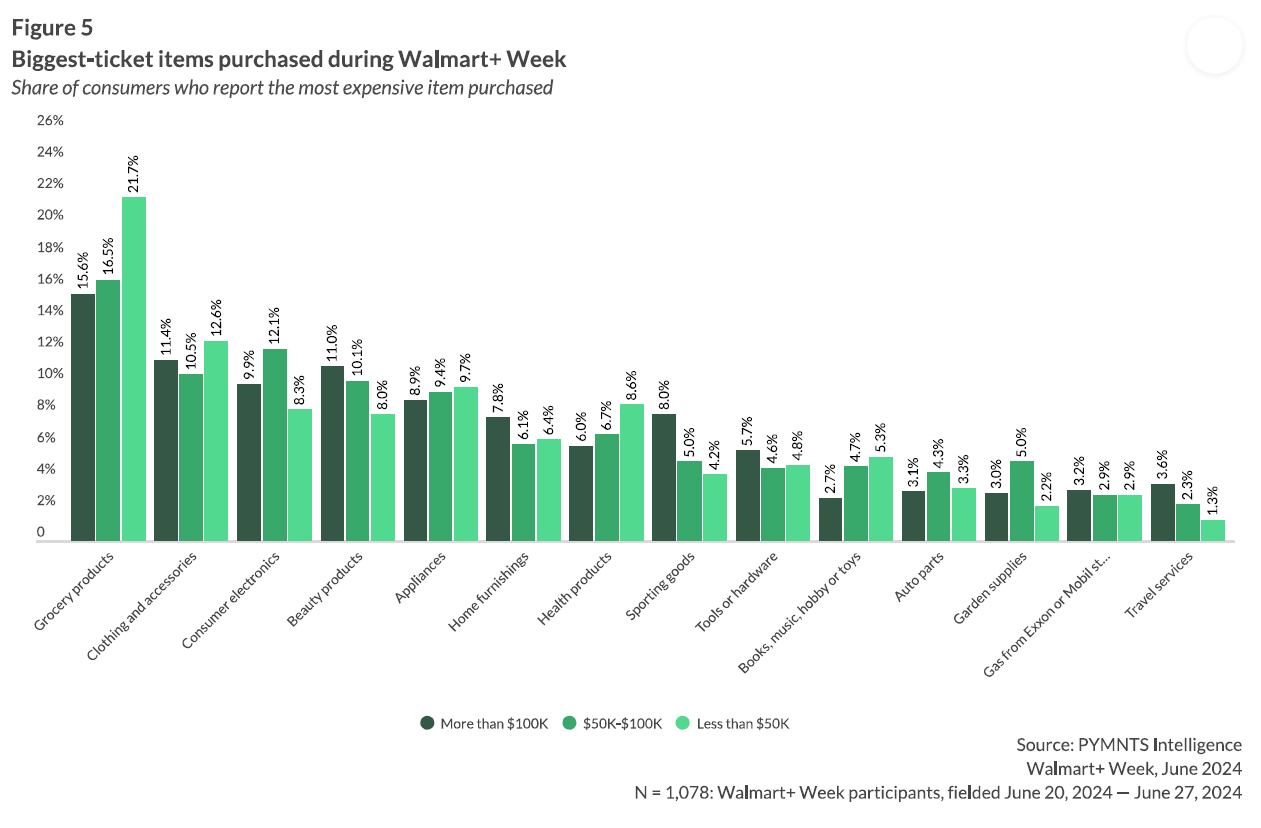

Notably, 67% of Walmart+ Week participants bought groceries, reflecting the retailer’s strength in this category. This trend differs from the typical focus of big-ticket sales events, which often highlight high-end electronics and appliances. High-income shoppers, however, displayed a different pattern. They were 55% more likely to purchase home furnishings and 32% more inclined to buy appliances compared to their low-income counterparts.

Despite this, groceries remained the top item across all income levels. For 22% of low-income subscribers, groceries were the most expensive item bought, compared to only 16% for high-income shoppers. This data suggests that while high-income consumers do splurge on larger items, groceries continue to dominate the shopping cart for Walmart’s diverse customer base.

Same-day grocery delivery is emerging as a crucial differentiator for Walmart+. Despite its partnership with Whole Foods, Amazon still imposes fees for same-day grocery delivery and offers it only in select locations. Walmart capitalizes on its vast grocery supply chain to provide this service more broadly and seamlessly. This advantage has clearly resonated with consumers.

This service is a major draw for Walmart+ subscribers, with 27% citing it as their primary reason for signing up. Yet, despite Walmart+’s efforts to carve out a unique niche, the report reveals a substantial overlap with Amazon Prime users—87% of Walmart+ subscribers also hold Amazon Prime memberships.

During Walmart+ Week, shopping patterns shifted markedly. In-store shoppers focused on groceries, leveraging Walmart+ for its grocery benefits. Online shoppers, however, explored a broader array of products, including high-ticket items. They bought an average of 20.6 items versus 14.9 items in-store, with 58.3% of online purchases on sale compared to 43.9% in-store. This indicates in-store shoppers prioritized grocery savings, while online shoppers capitalized on a wider range of sales.

As Walmart and Amazon compete for consumer dollars, Walmart must navigate the challenge of expanding beyond its grocery stronghold to attract a wider range of shoppers. Walmart+ Week featured strong grocery sales, but also highlighted a rising interest in non-grocery items. Participants who signed up specifically for the event were 2.3 times more likely to buy travel services and 1.5 times more likely to purchase electronics compared to regular subscribers.

To retain these new subscribers, Walmart must offer ongoing value beyond event promotions, as 58.3% of online purchases during the event were on sale. Balancing its grocery focus with a broader product appeal will be essential for Walmart’s sustained growth. The event underscored the importance of integrating varied consumer interests to maintain a competitive edge in the evolving retail landscape.